who pays sales tax when selling a car privately in michigan

The buyer and seller must go to a Secretary of State branch office together. However you do not pay that tax to the car dealer or individual selling the car.

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged.

. Streamlined Sales and Use Tax Project. But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher. Michigan requires a 6 use tax be paid by the seller on all private vehicle sales unless you are transferring the title to someone with a tax exempt status.

Government have a long history of taxing the sales tax on private vehicles and its not too uncommon for people to sell their car privately to avoid. By Kristine Cummings August 15 2022 August 15 2022. The seller paid sales tax when they bought the car so they only pay income tax on.

Custom Selling Used Car Privately Paperwork Available on All Devices. It depends on the length of the permit. All of the conditions that apply when buying a vehicle from an individual in a private sale also apply when buying inheriting or being gifted a vehicle from a family member.

Car Sales Tax on Private Sales in Michigan. Several examples of exceptions to this tax are vehicles. If the Vehicle Is Financed You can deduct the sales tax on vehicles you.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Can I Deduct Sales Tax On A Car In Michigan. However 6 sales tax isnt due with vehicle sales or transfers to certain relatives including the sellers.

For example theres a state sales tax on the. Notice of New Sales Tax Requirements for Out-of-State Sellers. A sales tax is required on all private vehicle sales in Michigan.

The Michigan Department of Treasury. The buyer will pay sales tax on the purchase price. As an example if you purchase a truck from a private party for.

The state of Michigan and the US. You also have to. If you own a car whether you purchased it new from a dealer or used from a private seller theres a 99 chance that you are liable to pay taxes when buying a car.

Michigan collects a 6 state sales tax rate on the purchase of all vehicles. The buyer will have to pay the sales tax when they get. And permits valid 60 days cost 20 of the annual.

According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. Its added to the initial cost of registration. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Start and Finish in Minutes. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Easy Online Legal Documents Customized by You.

If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid. After all a title transfer comes with fees and. The buyer pays sales tax on the purchase price of the car.

Provide Basic Information To Quickly Receive an Offer. Ad At AllCars You Can Sell or Trade-In Your Car With Us From Anywhere In the USA. We Make It Easy To Sell Your Car.

Selling a Junk Car in. Ad Legal Forms Ready in Minutes. When the excitement winds down you and your giftee will need to sit down and determine the logistical details of the car.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater.

The seller will need to provide proof of the vehicle identification number or VIN the vehicles registration card is a.

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Do Dealerships Pay Taxes When They Buy A Car For Resale

Car Tax By State Usa Manual Car Sales Tax Calculator

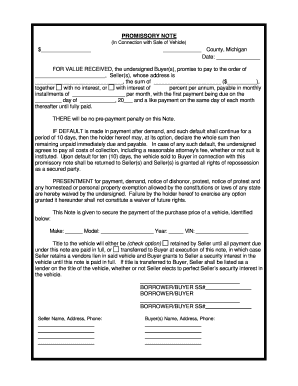

13 Printable Vehicle Purchase Agreement With Monthly Payments Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Illinois Car Sales Tax Countryside Autobarn Volkswagen

8 Tips For Buying A Car Out Of State Carfax

Bills Of Sale In Washington Forms Facts And More

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Title Transfer And Vehicle Registration

Price Jump For Used Cars Results In Boost In Michigan Sales Tax Collected Michigan Thecentersquare Com

How To Sell A Car In Michigan What The Sos Needs From Sellers

13 Printable Vehicle Purchase Agreement With Monthly Payments Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Nj Car Sales Tax Everything You Need To Know

7 Steps How To Get A Michigan Car Dealer License Surety Solutions A Gallagher Company

Title Transfer And Vehicle Registration

8 Tips For Buying A Car Out Of State Carfax

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto